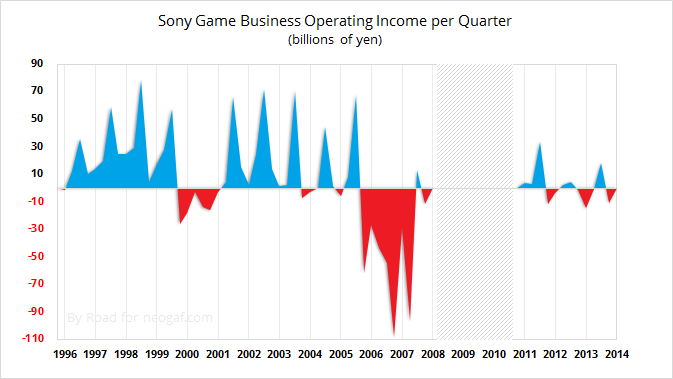

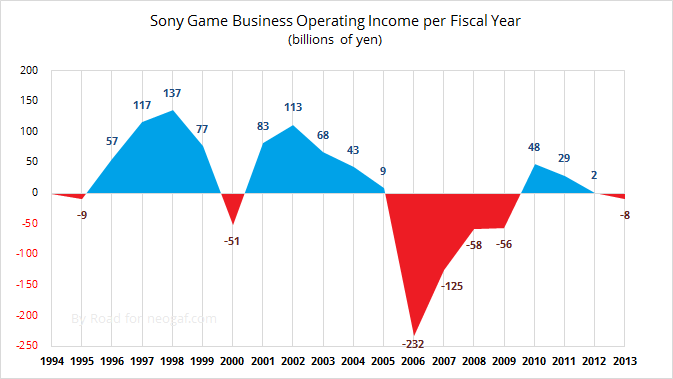

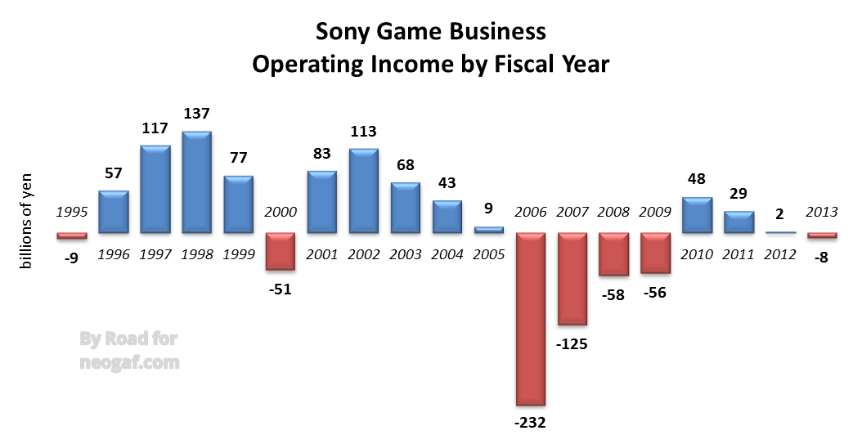

Focusing on gaming alone. Here are some charts from gaf:

I don't know what the hell "Network Services" they're including with Game are, but I know they''re not a good thing.

Game operating income

FY2013

without NS: -8.1 bn

with NS: -18.8 bn

negative impact of 10.7 billion yen

FY2012

without NS: +1.7 bn

with NS: -3.7 bn

negative impact of 5.4 billion yen

Some terribly lossy operation.

As you can see from that, the PS3 era was terrible for Sony. It took them four years to become profitable and they didn't make close to as much as they lost. This gen is off to a far greater start and next year they will be profitable, it should look a lot more like PS2 era.

Now lets compare nintendos income with sony's game division.

Just ridiculous what Nintendo was able to accomplish. Right now they are lost for the first time ever, its a all new ball game at Nintendo so I understand the worry. But they are by a mile the most profitable game company of all time.

Oh and there is this post at gaf:

Healthy? SCE's projected operating margins are 1.63% for next year. Average Consumer electronic companies have margins of around 9%, and that's not considering the fact that most of the Playstation divisions revenues come from software which should have margins closer to 20%.

Sony anything is far, far from healthy.

So plenty of back and forth. Sony is doing bad but it can go either way, seems like the building blocks for a positive future is there.

Are network services the cost that it takes to operate everything online such PSStore, servers for games, dlc, etc?

Sony's best years were 1997 and 1998....interesting. *cough FINAL FANTASY 7 cough*

edgecrusher said:Sony's best years were 1997 and 1998....interesting. *cough FINAL FANTASY 7 cough*

Metal Gear Solid

Dvader said:edgecrusher said:Sony's best years were 1997 and 1998....interesting. *cough FINAL FANTASY 7 cough*

Metal Gear Solid

Oh so sorry, the answer we were looking for was Gran Turismo.

---

Tell me to get back to rewriting this site so it's not horrible on mobileYodariquo said:Dvader said:edgecrusher said:Sony's best years were 1997 and 1998....interesting. *cough FINAL FANTASY 7 cough*

Metal Gear Solid

Oh so sorry, the answer we were looking for was Gran Turismo.

Damn it. You win.

Not sure about the pseudo GAF analysis. Sony are keeping cash in reserve by not using it to pay off the debt they owe. It's like someone not paying his mortgage and keeping cash under the bed instead. Bottom line is they are, have and will be losing money. Everyone has to pay off their debt eventually. Hacking off unprofitable sectors will help.

Having money making operations is good, but if it's not making enough money to pay off debts and operating costs then they are still losing money at the end of the day. They need to make enough money to pay off the bills and then make a profit on top.

Holee shit that gif graph, the Wii/DS was like an explosion.

Foolz said:This thread brought to you by Polygon.

I will not stand to be directly insulted like that. Screw you foolz.

http://www.gamesindustry.biz/articles/2014-05-15-sonys-still-on-track-despite-tough-figures

Good read bros

Bloomberg: Sony Breakup Would Be Better Late Than Never: Real M&A

One year and about $2 billion in lost market value later, it may be time for Sony Corp. (SNE) to take Daniel Loeb’s advice about breaking up.

Even after making restructuring attempts such as the sale of its personal computer division, Sony remained 12 percent lower as of last week than when activist investor Loeb first urged a separation of the entertainment business last May so that the company could focus on its struggling electronics business. Last week, Sony forecast an annual loss, its sixth in seven years, mostly because of swelling restructuring charges. The shares subsequently plunged 8.8 percent as of May 16.

“Last year there was some hope, and now we’re seeing a capitulation of that hope,” Daniel Ernst, an analyst at Hudson Square Research Inc. in New York, said in a phone interview. “The worse the electronics part of the company does, the more pressure there will be to look at” Loeb’s suggestion.

While Sony (675

is banking on ultra-high definition, or 4K, televisions and high-end smartphones to reverse the declines in its electronics unit, those products won’t be the saving grace it needs, Ernst said. Separating the entertainment division, which makes the “Spider-Man” films and represents music artists such as Miley Cyrus, would let investors value the more profitable parts of Sony separately while it tries to fix electronics, according to RiverFront Investment Group LLC.

Photographer: Simon Dawson/BloombergDaniel Loeb, billionaire and chief executive officer of Third Point LLC. Loeb’s Third Point LLC urged Sony last May to sell as much as 20 percent of its profitable entertainment unit in an initial public offering so the Tokyo-based company could focus on the electronics division. Close

Daniel Loeb, billionaire and chief executive officer of Third Point LLC. Loeb’s Third... Read More

Close

Open

Photographer: Simon Dawson/Bloomberg

Daniel Loeb, billionaire and chief executive officer of Third Point LLC. Loeb’s Third Point LLC urged Sony last May to sell as much as 20 percent of its profitable entertainment unit in an initial public offering so the Tokyo-based company could focus on the electronics division.

Based on the sum of its parts, Sony could be valued at 2,090 yen a share, 27 percent more than last week, according to Atul Goyal of Jefferies Group LLC. Bedell Frazier Investment Counselling LLC’s estimate suggests an even higher premium of as much as 53 percent.

Good/Bad

A breakup is “long overdue,” Chris Konstantinos, who helps oversee about $4.5 billion as director of international portfolio management at RiverFront in Richmond, Virginia, said in a phone interview. “You could almost do what I would term a ‘good bank/bad bank’ type of scenario.”

Loeb’s Third Point LLC urged Sony last May to sell as much as 20 percent of its profitable entertainment unit in an initial public offering so the Tokyo-based company could focus on the electronics division.

While Sony rejected the plan in August, it said in February it would sell its PC business to buyout firm Japan Industrial Partners Inc. and also split its TV manufacturing unit into a separate operating entity. Chief Executive Officer Kazuo Hirai said he hasn’t ruled out a divestiture of that business.

Photographer: Kiyoshi Ota/BloombergA Sony Computer Entertainment Inc. PlayStation 4 (PS4) video game console sits on display at a Bic Camera Inc. electronics store in Tokyo, Japan. Close

A Sony Computer Entertainment Inc. PlayStation 4 (PS4) video game console sits on... Read More

Close

Open

Photographer: Kiyoshi Ota/Bloomberg

A Sony Computer Entertainment Inc. PlayStation 4 (PS4) video game console sits on display at a Bic Camera Inc. electronics store in Tokyo, Japan.

Sony is “focused on creating shareholder value by executing on our plan to revitalize and grow the electronics business, while further strengthening the entertainment and financial service businesses,” Ayano Iguchi, a company spokeswoman, wrote in an e-mail May 15.

A representative for Loeb declined to comment.

Market Pressure

Last week, Sony reported a 26 billion yen ($257 million) operating loss for the TV-making business in the year ended March 31, which the company said brings the unit’s total operating losses over the past decade to about 790 billion yen. It also projected a 50 billion yen companywide net loss for this year.

The stock dropped to 1,646 yen last week from 1,877 yen at the time of Loeb’s suggestion last May. Sony climbed as high as 2,295 yen in July before rejecting his proposal the next month.

Sony fell 1.2 percent to 1,627 yen at today’s close of trading in Tokyo. The American depositary receipts dropped 1.7 percent to $16.11 at 10:08 a.m. New York time today.

“Pressure is mounting,” Mike Frazier, president and CEO of Bedell Frazier, which oversees about $400 million including Sony ADRs, said in a phone interview. The market has “been frustrated for a while, but even the bull case is starting to get frustrated. For the time being, we’re staying in there but we’re contemplating our next move.”

Disparate Units

Sony’s operations sprawl from film and music studios to TV and camera products to PlayStation video games and consoles. It also offers financial services, such as life insurance.

“What does the film entertainment and the audio entertainment businesses have to do really with PlayStation or with TV sets or with camera modules? The answer is not much,” said Brian Barish, president of Denver-based Cambiar Investors LLC, which oversees about $11 billion, including Sony ADRs. “The chorus to break off the entertainment assets from the rest will grow much louder.”

A breakup would make it easier for investors to assess the disparate units, said Konstantinos of RiverFront. One way of doing that would be to put higher-growth divisions, including PlayStation and entertainment, in one business and more commoditized operations, like TV, in a “cash cow” business focused on buybacks and dividends, he said.

Conglomerate Distaste

“I tend to be one of those investors who doesn’t appreciate having to look at conglomerates,” Konstantinos said. By splitting a company into two, “not only are you allowing shareholders to choose for themselves which sort of investment style they want to pursue, you’re also freeing up management.”

Sony’s electronics business could use the extra attention, said Ernst of Hudson Square. The cost cutting and restructuring only go so far and those actions don’t solve the problem of reviving revenue, he said.

“What Sony really needs is new product momentum,” Ernst said. “Based on what we see now, I don’t see that in electronics.”

While the company projected a 28 percent jump in mobile products revenue this year and 17 percent growth for TV sales, the forecasts are too optimistic, according to Masahiko Ishino, a Tokyo-based analyst at Advanced Research Japan Co.

Trailing Smartphones

In smartphones, the company faces competition in the high-end market from South Korea’s Samsung Electronics Co. (005930) and Apple Inc., based in Cupertino, California. Sony accounted for 3.8 percent of global smartphone sales in 2013, compared with Samsung’s 31 percent and Apple’s 15 percent, according to data compiled by Bloomberg from International Data Corp.

“They’ve got competitive threats from many different angles they didn’t have in years past,” Ben Bajarin, an analyst at consulting firm Creative Strategies Inc., said by phone.

Excitement about 4K TV sets -- which Sony has touted as central to reviving that unprofitable unit -- will weaken as eventually most TVs offer that quality, said Goyal of Jefferies.

Those challenges may argue for getting rid of the electronics business altogether, he said.

Others, such as Lawrence Haverty of Gamco Investors Inc., are more bullish on the electronics business. Industrywide sales of 4K TVs are poised to leap more than 11-fold from 2013 to 2018, according to IDC.

Sony also has already taken steps to get the company on the right track, said Amir Anvarzadeh, manager of Japanese equity sales in Singapore at BGC Partners Inc., who says he had been bearish on the company for years, until recently.

Looking Better

“For the first time over the last four or five months, I am seeing real signs that the company is doing all the right things,” Anvarzadeh said by phone. “You could argue that it’s come too late, but we are where we are and the question is, ‘How would you restructure this business at this stage?’”

Severing ties between the electronics and entertainment operations now would be a mistake, he said.

“For Sony to give up its best businesses, its highest cash-flow generating businesses, when it needs it the most, doesn’t makes any sense,” Anvarzadeh said.

Even so, investors should be allowed to choose which part of the business they want to invest in, said Konstantinos of RiverFront. A breakup could be “the next logical step,” he said.

“It seems like the electronics business in general continues to just disappoint,” Konstantinos said. “After some of the bad quarters they’ve had, some people were starting to get the idea that maybe all the bad news was priced in. This was sort of a wake-up call. It’s ripe for some sort of shake-up.”

Sony's fiscal results for 2013 came in and like they reported before they took an insane $1.2 billion loss. Their forcast for next year is to take a $492 million loss. The game division posted a $78 million loss but that is actually decent considering other launch years (most of that loss was due to SOE and MMOs).

Sony is predicting 17 million Sony consoles to be sold next year and 3.2 million portables to be sold. They expect software to be up this year as well.

Now lets break this all down. I read the entire gaf thread and kind of came up with some understanding of what it all means, so here we go. First the game division operating income which is the best way to determine the profitability of a sector.

As you can see next year they will be up and should stay up for some years as PS4 dominates.

Now lets look at Sony as a whole

Taken from gaf

The MP&C segment includes the Mobile Communications and Personal and Mobile Products categories. Mobile Communications

includes mobile phones; Personal and Mobile Products includes personal computers.

The IP&S segment includes the Digital Imaging Products and Professional Solutions categories. Digital Imaging Products includes

compact digital cameras, video cameras and interchangeable single-lens cameras; Professional Solutions includes broadcast- and

professional-use products.

The HE&S segment includes the Televisions and Audio and Video categories. Televisions includes LCD televisions; Audio and Video

includes home audio, Blu-ray DiscTM players and recorders and memory-based portable audio devices.

The Devices segment includes the Semiconductors and Components categories. Semiconductors includes image sensors; Components

includes batteries, recording media and data recording systems

Starting from the second quarter ended September 30, 2013, the disclosure for sales to external customers for the Pictures segment has been

expanded into the following three categories: Motion Pictures, Television Productions, and Media Networks. Motion Pictures includes the

production, acquisition and distribution of motion pictures; Television Productions includes the production, acquisition and distribution of

television programming; Media Networks includes the operation of television and digital networks.

Starting from the second quarter ended September 30, 2013, the disclosure for sales to external customers for the Music segment has been

expanded into the following three categories: Recorded Music, Music Publishing and Visual Media and Platform. Recorded Music

includes the distribution of physical and digital recorded music and revenue derived from artists’ live performances; Music Publishing

includes the management and licensing of the words and music of songs; Visual Media and Platform includes various service offerings for

music and visual products and the production and distribution of animation titles.

The Financial Services segment results include Sony Financial Holdings Inc. (“SFH”) and SFH’s consolidated subsidiaries such as Sony

Life Insurance Co., Ltd. (“Sony Life”), Sony Assurance Inc. and Sony Bank Inc. (“Sony Bank”). The results of Sony Life discussed in the

Financial Services segment differ from the results that SFH and Sony Life disclose separately on a Japanese statutory basis.

So as you can see financial services is really all that Sony has that is makes constant money. The PC sector was their biggest money sink and they plan to get rid of that. TVs are getting better but still not profitable. Movies and music stay profitable. Sony is already addressing the areas that have most hurt them, though it is taking a long time to get rid of that crap.

So is Sony in bad shape, yes but they seem to be on the road to recovery. Despite the huge losses in terms of actual on hand cash Sony MADE MONEY this year, first time in three years. From gaf:

On a positive note, Sony as a whole was cash positive for the first time in three years, they ended the year with more money in the bank than when they started. I figured this was via the issuance of debt, but alas it is not and actually from their operations. Newly added debt comes to about 130bn yen, cash added comes to around 175bn yen. While there are translation additions because of weak yen, one would expect that in a year where they lost 125bn yen they would drain their cash reserves to some degree. If one were to include their banking division they are in an even stronger position.

It means that the losses are largely on paper, the core business seems to be generating cash, though I will have to give it a proper read before I can say that conclusively.

So what exactly is going on. It seems like Sony just owes a ton of money, but their core business is actually profitable. With some smart moves they can fix their situation. Another post on the subject:

Critically, the core business is actually marginally profitable and they decreased their net indebtedness by around $500m over the year and increased their revolving finance facilities to over $7bn (access to money if they need it, Moody's am cry). A lot of the losses over the last few years have been paper losses, asset impairments, DTA write downs and such. What that means is money either spent in the past or in the case of a DTA, the asset taken on for tax losses carried forwards, are now being written off as they are not going to get that money back. They spent the money, previously and now they won't get it back through their normal operations.

It is a huge difference to a company that actually loses money outright where their normal operations cost more than the revenue they generate from sales. Nintendo are in this category which is why their situation seems worse than Sony's and they don't really have a clear path to recovery like Sony (getting rid of the TV division) because their problems stem from deeper issues such as smartphones killing their handheld business and being stupidly uncompetitive in the home console market.

For all their current faults, Sony still have a profitable smartphones division, a hugely profitable financial services division, their content division (pictures+music) reliably makes $1bn per year in operating profit and their games division seems to be recovering very nicely after the PS3 caused so much turmoil. In essence if they jettison the TV division they would be pretty healthy and though they would hold a significant amount of debt but they would be profitable, more than enough to redeem bonds and meet their financial obligations. I guess the issue is that it has cost Sony $1.7bn to exit PCs and I expect the cost of exiting TVs would be double because all 30,000 employees would need paying off and the losses on current stock and contracts would need to be written off.

Essentially, though it is true they lose money, a lot of it is on paper, and the core business is generating cash.

So its not all doom and gloom.